Dividend per share formula

In the above formula. Calculate the dividend per share of the.

Dividends Per Share Meaning Formula Calculate Dps

They are distributed from the pool.

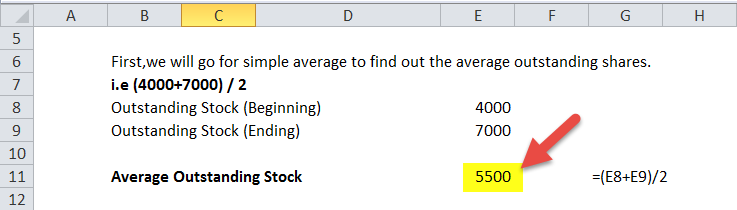

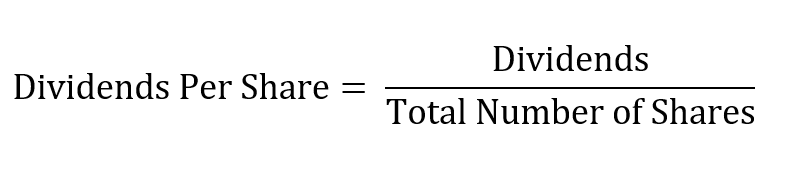

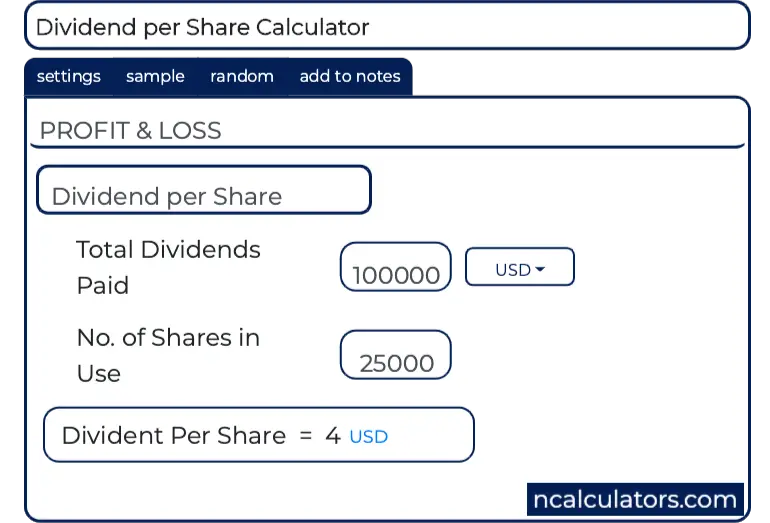

. Dividends Paid 3000000. To calculate the dividend per share you need to know the total dividends paid and the outstanding shares. Per Share The denominator of the dividends per share formula generally.

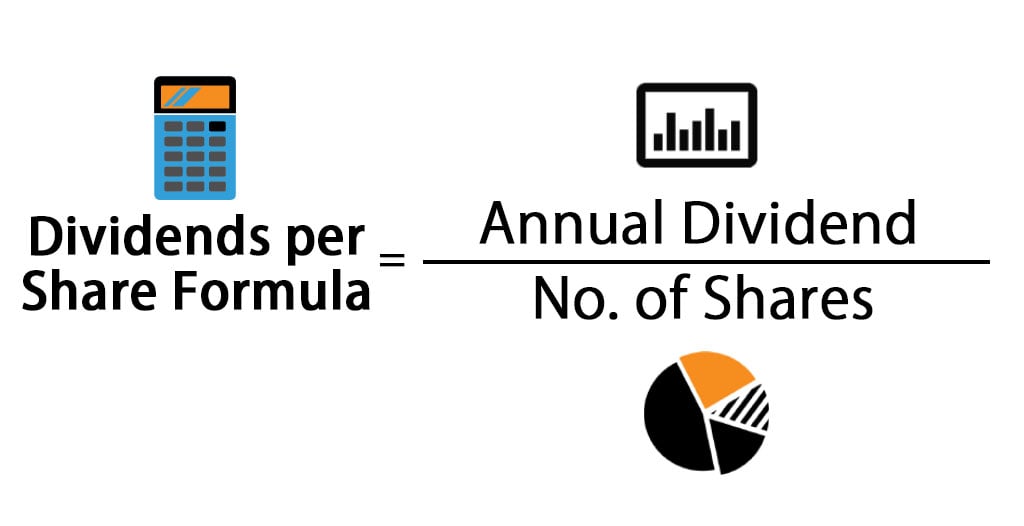

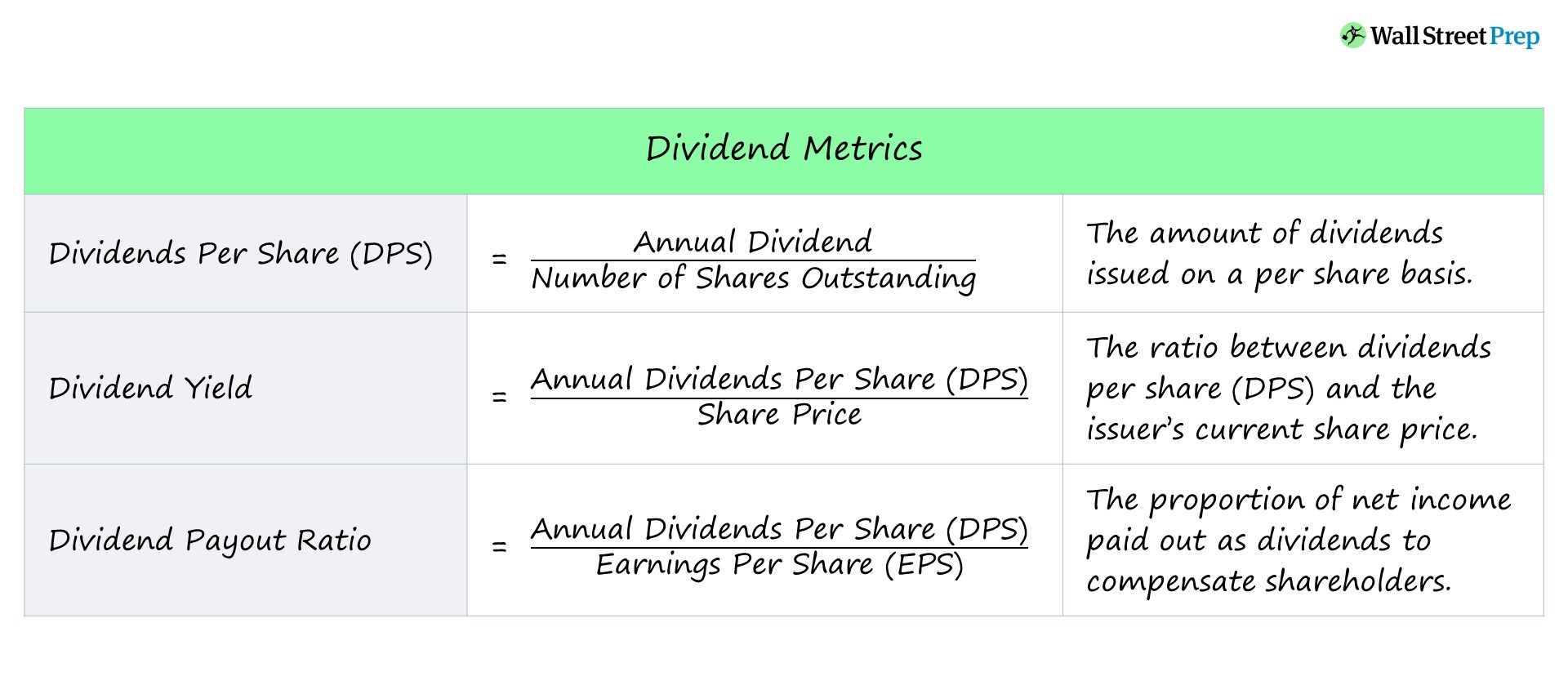

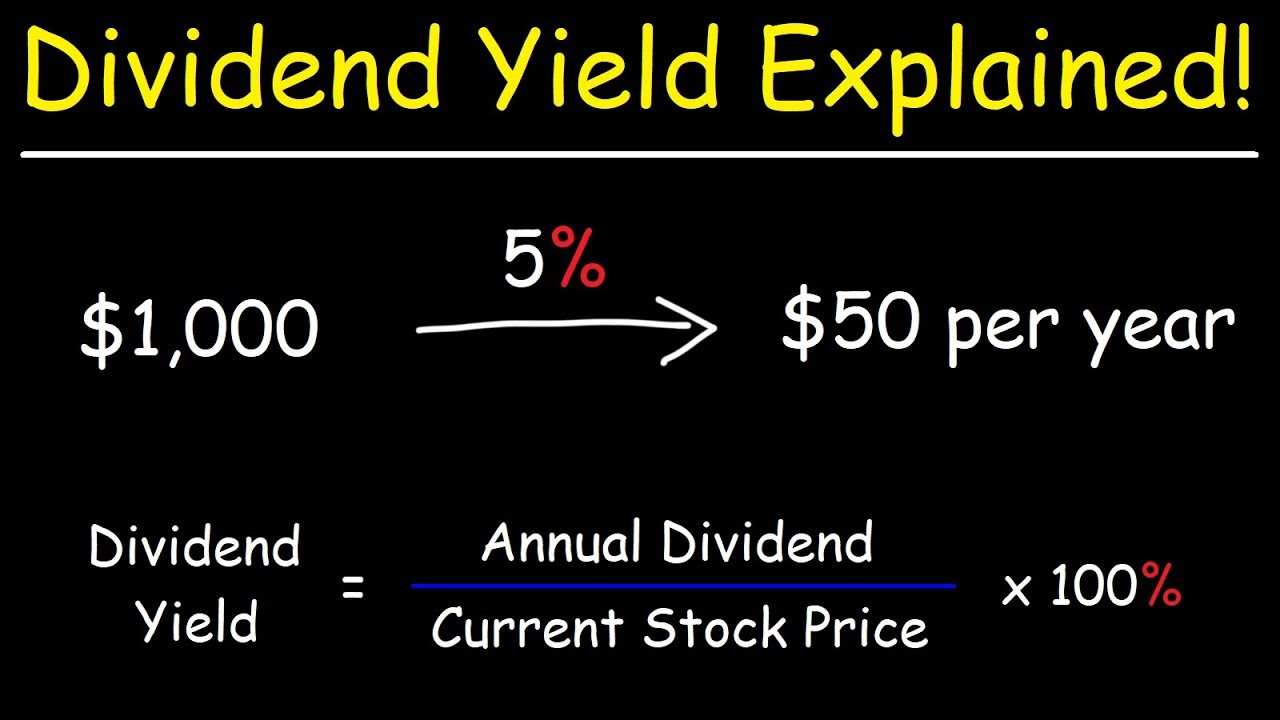

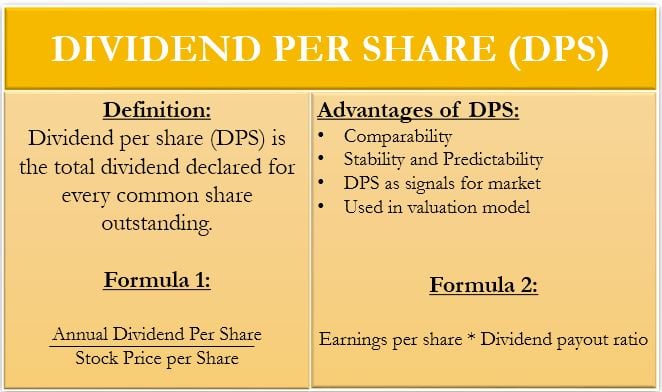

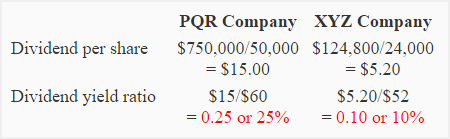

The formula for dividends per share or DPS is the annual dividends paid divided by the number of shares outstanding. The Formula of Dividend Growth Rate Using the Compound Growth D DnD01n-1. Based on the formula above if you divide the annual dividend per share of 822 by the current market price per share of 18032 you get a dividend rate of 456.

The total annual dividends of the shareholder was Sh. The dividend per share formula is as follows. The DPS of ABC is.

Investor with 100 shares. Even if you put it in the formula the total number of outstanding shares cancel out. Here is an example.

How to Calculate Dividends Per Share DPS in 3 Steps. Dividend per share is the companys total annual dividend payment divided by the total number of shares. Dividend Yield Dividend per share Market value per share Where.

DPS dividends - annual dividend amount shares outstanding. The simplest and most straightforward method uses the traditional dividend per share formula. The shares are good for.

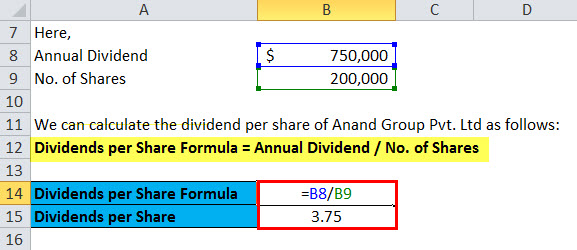

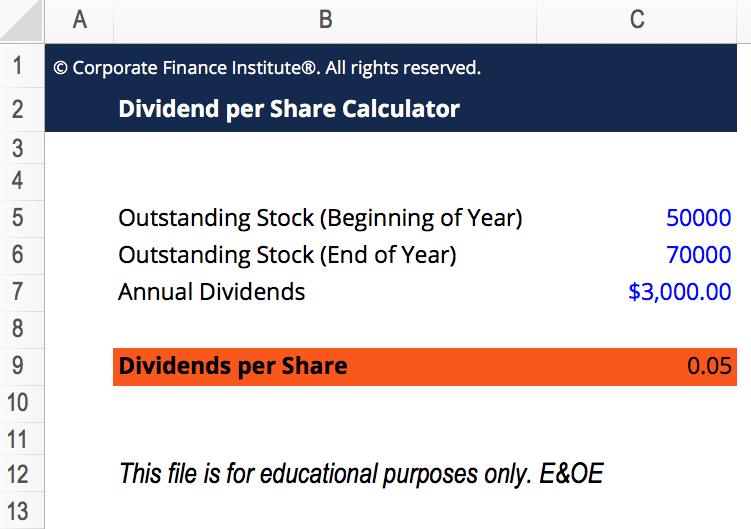

22 2022 447 PM ET AKOB BCC BGFV BHP CMRE CTRA FSK HIMX ICL KRO LOMA PCH RIO SBSW TX VIA. Dividends per share is calculated by dividing the total number of dividends paid out by a company including interim dividends over a period of time by the number of shares. 12000000 and the number of the outstanding common stock for the year was 180000.

100 x 050 50 Dividend Income Mutual funds and exchange-traded funds also pay dividends to their investors. Total dividends are Rs 175 per share. Sum of all periodic dividends in a year Sum of all special dividends in a year Weighted average number of common shares.

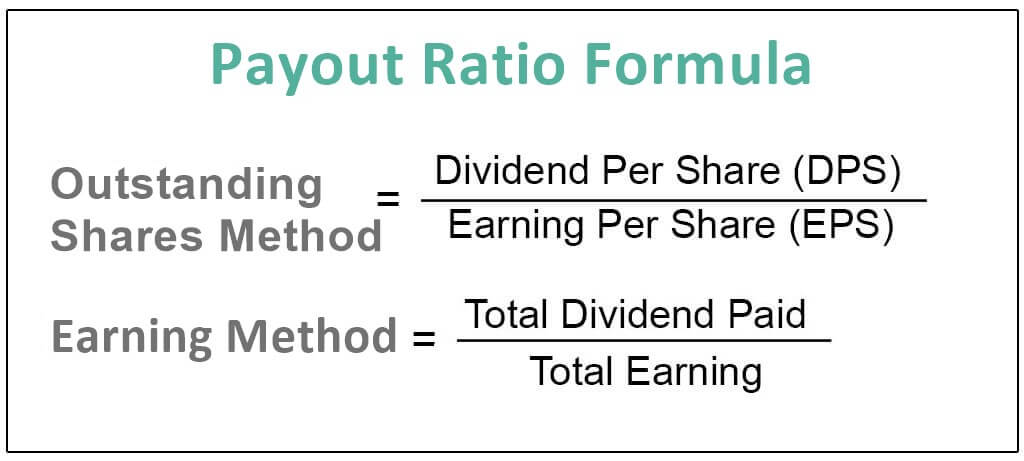

DPS EPS x Dividend Payout Ratio. 23 September Value Buys Per Ben Grahams Formula. Since the question requires us to use semi-annual.

The outstanding shares are the total of all shares currently held by. 175 x outstanding sharesoutstanding. Determine a companys typical dividend.

DPS is calculated by dividing the total dividends paid out by a business including interim dividends over a period of time usually a year by the number of outstanding ordinary. Dividends Per Share Annualized Dividend Amount Number of Shares Outstanding The dividend issuance amount is typically expressed on an annual basis meaning that a quarterly dividend. Dividend per share DPS and the yearly growth rate.

237000 - 60000 3000000 0059 per share. The dividend per share DPS is a simple formula that takes the total dividend payment and divides it by the total number of outstanding shares.

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-03-4a893d6e5ada40ecaa56ea3f7fc0db4a.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Dividends Per Share Dps Formula And Calculator

Dividend Payout Ratio Formula Guide What You Need To Know

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividend Definition And Examples Of Dividend Stocks

Dividend Yield Formula How To Calculate Dividend Yield

Dividend Formula Examples How To Calculate Dividend Ratio

Payout Ratio Formula How To Calculate Dividend Payout Ratio

The Dividend Yield Basic Overview Youtube

What Is Dps Dividends Per Share And Dividend Yield Knowledgebase

Dividends Per Share Formula Calculator Excel Template

Dividend Per Share Dps Calculator

Dividend Per Share Dps Efinancemanagement

Dividend Per Share Business Tutor2u

Dividend Per Share Calculator Free Excel Template Download Cfi

Dividend Yield Ratio Explanation Formula Example And Interpretation Accounting For Management